[vc_row][vc_column][vc_column_text]

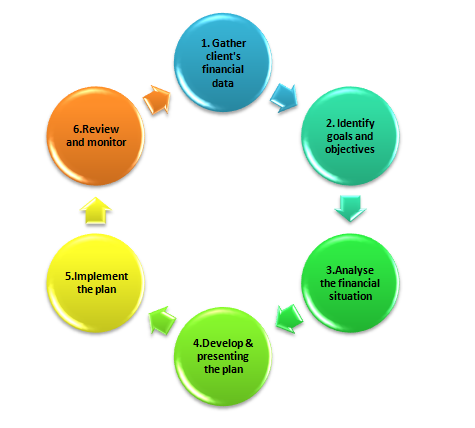

Gather client’s financial data– including income, expenses, debt levels and commitment.

Identify client’s goals and objective– These may include buying house, funding for education, travel, retirement needs and any financial needs.

Analyse the financial situation– Condition aiding or impeding the client’s desire to achieve his financial goals, time horizon to achieve them need to be modified.

Develop and presenting the financial plan– prepare a financial plan that identifies recommendations, alternative strategies, the advantages and disadvantages of each strategy should be communicate.

Implement the plan– the financial plan is useful to the client only after it is put into action.

Review and monitor the plan– reviewing the revising the plan to ensure it stays up-to-dates and relevant to the economic climate and the client’s changing lifestyle.

Service Provider

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]

[ih-gallery id=”1728″]

[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_empty_space height=”15px”][vc_column_text]

BANK

OCBC Bank (M) Bhd

Standard Chartered Bank Malaysia Bhd

Hong Leong Bank Bhd

Alliance Bank Malaysia Bhd[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]

[ih-gallery id=”1735″]

[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_empty_space height=”15px”][vc_column_text]INSURANCE

Great Eastern Life Assurance (M) Bhd

Great Eastern Takaful Berhad

Oversea Assurance Corporation (M) Bhd

AIA Bhd

Prudential Assurance Malaysia Bhd[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]

[ih-gallery id=”1738″]

[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_empty_space height=”15px”][vc_column_text]WILL AND TRUST

Rockwills Corporation Sdn Bhd[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]

[ih-gallery id=”1739″]

[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_empty_space height=”15px”][vc_column_text]

INVESTMENT

Phillip Mutual Berhad

Aberdeen Asset Management Sdn Bhd

Affin Hwang Asset Management Berhad

AmanahRaya Investment Management Sdn Bhd

AmInvestment Services Berhad

[expander_maker more=”Read more” less=”Read less”]

Areca Capital Sdn Bhd

BIMB Investment Management Berhad

CIMB-Principal Asset Management Berhad

Eastspring Investments Berhad

Franklin Templeton Asset Management (M) Sdn Bhd

Inter-Pacific Asset Management Sdn Bhd

KAF Investment Funds Bhd

Kenanga Investors Berhad

Libra Invest Berhad

Manulife Asset Management Services Berhad

Maybank Asset Management Sdn Bhd

MIDF Amanah Asset Management Berhad

OPUS Asset Management Sdn Bhd

Pacific Mutual Fund Berhad

Pheim Unit Trusts Berhad

PMB Investment Berhad

RHB Asset Management Sdn Bhd

TA Investment Management Berhad[/expander_maker][/vc_column_text][/vc_column][/vc_row]

Recent Comments